19 Jun Cashless Options In Tokyo / How to setup PayPay and Merpay

2023 Update: A more recent 2023 article on payment apps can be found here

Have you been living in Tokyo for some time now and getting tired of walking around with loads of cash in your wallet?

Soon to live in Tokyo and want to know what cashless options there are?

Even though Japan has been slow in moving towards a cashless society, some excellent companies are emerging and aiming to help with quick payments and keeping your wallet lighter.

Rapidly Growing Landscape for Cashless Options

With the Olympics on its way and the Osaka World Expo in 2025, there is sure to be an influx in foreign tourists. With that in mind, the government wanted to boost the economy by getting cash flowing. They realized that it’s easier for people to swipe a card and make some payments rather than spending bills. Since credit cards are still not as common (read our article here on the best credit cards out there for Expats in Japan), they have pushed for and backed up some cashless options.

Companies such as RPay (Rakuten Pay), LINE Pay, Google Pay, and Apple Pay, have a great cashless Ecard set up, and even provide their apps in English. Although those are great options, some options are more common in Japan, which becomes apparent the more you shop, train ride, and walk around the city. The latest, most present, and possibly the most popular cashless option, is the PayPay app.

In this article, we will go over a few of the most common cashless options. Since the services below are in Japanese, we will help you navigate them and start the cashless life you’ve been longing for in Tokyo.

PayPay

PayPay sounds similar to the ‘PayPal’ system we Expats know. However, PayPay works more like a prepaid cash card, than a banking system. The app, which is free to use and download onto your smartphone, has exploded with popularity because of its cash back rewards, and shop owners love how easy it is to setup for commerce. You pull up the App on your smartphone and load it with funds with your credit card, your bank account, or cash through Seven Bank ATM.

The only downside for us Expats who don’t read Japanese, is that the App is only in Japanese.

Have no fear- that’s why we are here!

If you want to jump on the PayPay bandwagon and make life easier going cashless, please follow our translated steps below! ( here are the steps on PayPay’s website: https://paypay.ne.jp/guide/start )

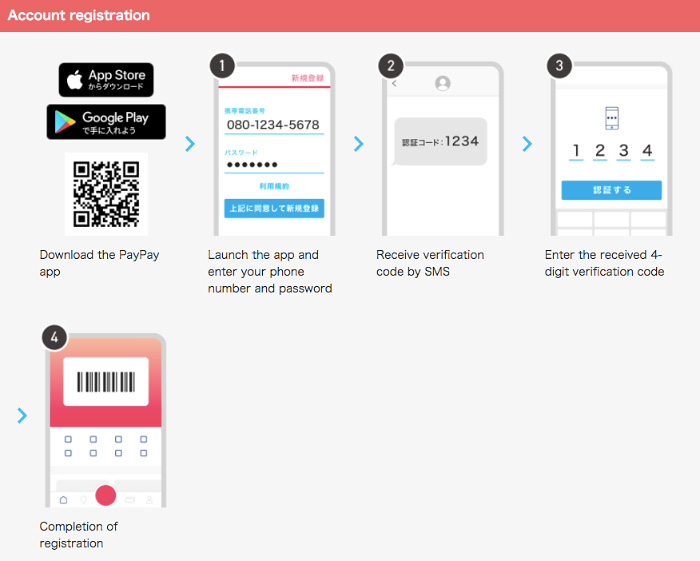

How to Apply?

– Enter your phone number and a password to receive a confirmation code. Enter the code received through text and complete the registration.

PayPay registration (2020 June)

– They have three options: Bank Account, Seven Bank ATM, or a credit card.

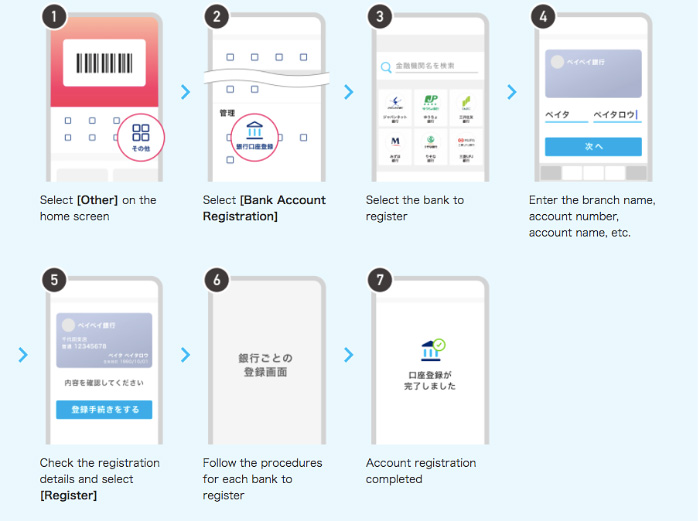

••• PayPay with Bank Account:

Select Other (その他) on the home page. Select the Bank Account Registration (銀行口座登録) and choose your bank. Then enter your account information: Branch name, account number, and account name.

PayPay registration, bank account select (2020 June)

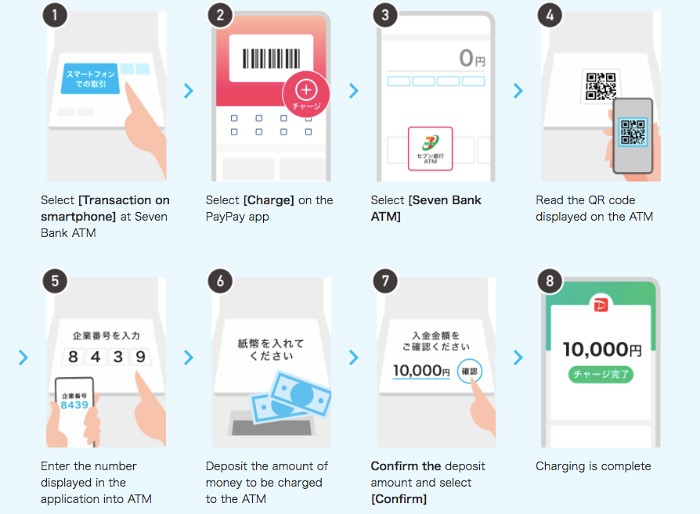

••• PayPay with Seven Bank ATM:

You do not need a bank card with Seven Bank to use this system.

Go to a Seven Bank ATM. Select Transaction on Smartphone (スマートフォンでの取引) at the ATM

-On your PayPay App, select Charge (チャージ) and then Seven Bank ATM. Scan the QR code found on the ATM and then enter the confirmation number. Deposit your desired amount of money you would like charged to your account. Press Confirm (確認), then your deposit is complete.

PayPay registration, Seven Bank ATM select (2020 June)

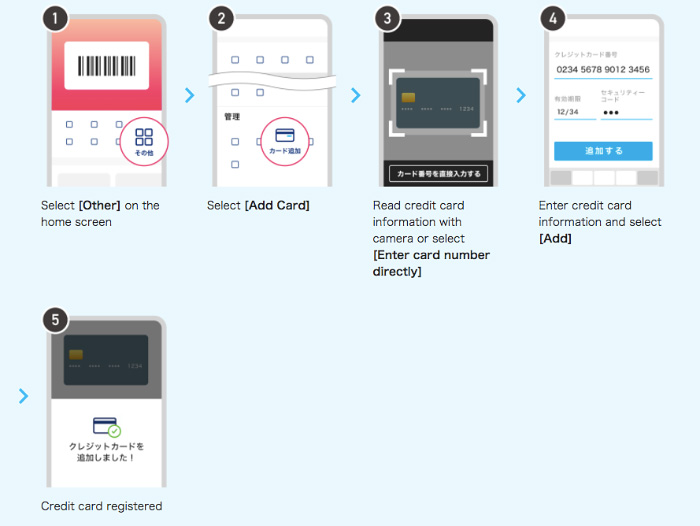

••• PayPay with Credit Card:

Select Other (その他) on your PayPay App, then select Credit Card (カート追加) Automatically read the card through your photo camera or enter the card manually. Select add (追加する) and then you are done.

PayPay registration, credit card select (2020 June)

How to Pay?

Select pay on the App and have the shop clerk scan your barcode OR use the QR reader. Scan the QR code found at the shop, enter the amount you would like to pay, show to confirm with the store clerk, and then push pay (支払う).

Where Can You Use PayPay?

– restaurants

– shops

– convenience stores

Over 2 million locations nationwide!

Just look for their P sign ![]() to know that the shop accepts PayPay.

to know that the shop accepts PayPay.

Merpay

Merpay is Mercari’s cashless paying system (Mercari is one of the e-marketplace kings of Japan). Merpay’s primary function is its use for their online selling site, yet, you can also use it at many shops and restaurants around the city. Ask any of your Japanese friends how they sell their used items, and everyone will mention Mercari. It is easier to sell your unwanted goods then throw them away as trash. Since I am sure you know how trash is such a big and complicated ordeal here in Tokyo (Need help on how to sort your trash in Tokyo? Check out this article). Merpay has bought the cashless company, Origami, to merge their systems and make one excellent service. Earn cash as you sell your items and then go use that at many different shops without feeling stuck using it only on their website. Even if you don’t sell items, you can add money to the app and have all of your cashless payment options in one place.

How to Apply?

mercari login (2020 June)

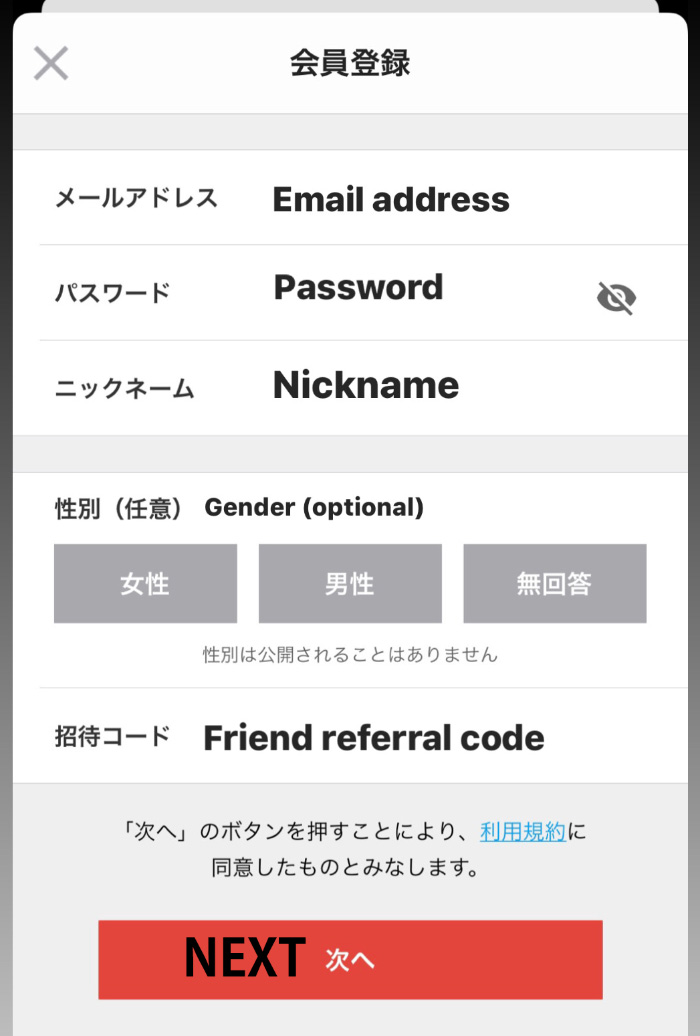

*Choose how you would like to create an account; here we will show you how to set it up with an email account (last option, red button). Click the mail mark on the setup options

mercari registration (2020 June)

-Add your email address on the first line (メールアドレス)

-Next line is your password (パスワード), choose their generated password (the top option) or create your own (second option). If you create your own, you need to use a capital letter and a number.

-Third line is to choose a nickname (ニックネーム) for yourself that will be your username

-Next section is optional to select a gender (性別(任意)). From Left to Right, female, male, or No Answer

-The last section is a friend referral code if you have one (招待コード)

mercari registration, name entry (2020 June)

*Enter in Your Name

-The top line is your family name in Kanji (If you do not have Kanji enter it in Roman/Alphabetical letters.

-2nd line is your Given Name (again Kanji is not necessary)

-3rd line is Family Name in Katakana (here you do need to enter it in Katakana)

-4th line Given Name in Katakana

-5th line is your Date of Birth

-push next

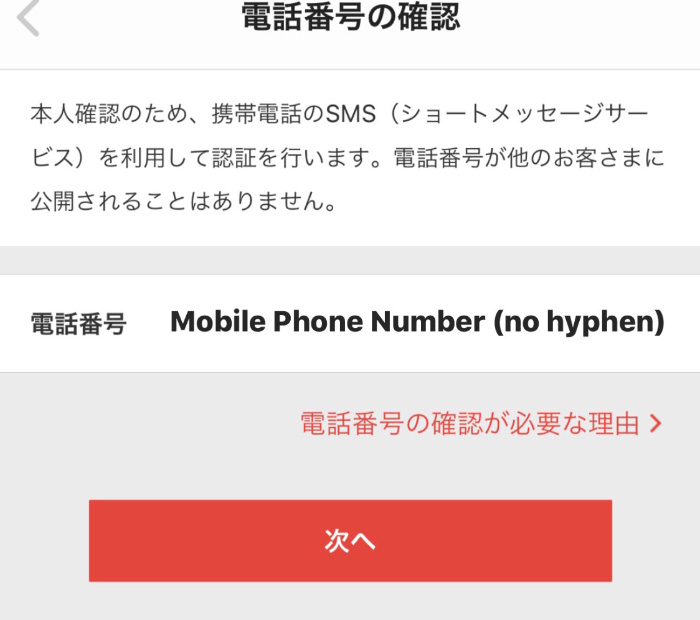

mercari registration, mobile number confirmation (2020 June)

mercari registration, sms confirmation (2020 June)

-it will confirm the phone number you entered and then push Send (送る)

-enter the code they sent through text

-This part is up to you, but you can push decline and set up a credit card later if you would like. The top button is yes, and the bottom button is decline.

Where can you use it?

Now you are all set up and can start shopping or use your cashless option for stores. If you would like to buy something at over one of their 1.7 million retailers that accept Merpay (restaurants, convenience stores, online shops), click on the ¥ mark at the bottom of the App, and it will take you to a page where you can pay.

How to Pay?

Pay through the App using the QR code reader or a barcode scanner. You can add money through Seven Bank ATM similar to PayPay mentioned above, a credit card, or connect it to your bank account.

mercari / merpay / 500 points (2020 June)

If you see P500, that means you have 500 points, which is equivalent to ¥500.

Even though the above services are in Japanese (as of 2020 June), we hope this detailed explanation can get you set up and start shopping as the Japanese do. Why not try venturing out and sell some of your unused stuff through Mercari while you are at it!

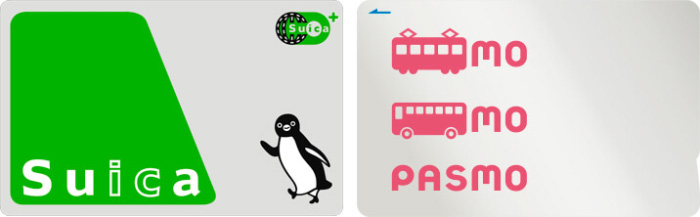

Suica and Pasmo

Suica and Pasmo have been the staple cashless options for many years and mainly used as Ecards for public transportation. Suica is operated by JR train lines and Pasmo for metro systems. They have expanded their services to some shops, and even vending machines, giving you the option of using your Ecard at places other than transportation.

Suica and Pasmo are chargeable cards that you can fill up at any train station or conveniently add it to Apple Pay (for iPhone users) or Google Pay (for Android users). Pasmo is only available as an App for Android users.

Getting Suica or Pasmo at a train station

How to get a Suica card:

https://www.jreast.co.jp/e/welcomesuica/welcomesuica.html

How to get a Pasmo card:

https://www.pasmo.co.jp/visitors/en/normalpasmo/

Suica app

-You can add your credit card information and load money onto the Suica card.

Where can you Pasmo or Suica?

Pasmo and Suica are most commonly used for public transportation, such as trains, buses, and taxis.

It’s also very common to use them at convenience stores, fast-food chains, and vending machines. Just tap your Ecard on any IC chip reader.

Bonus* Get a commuter pass put onto your Ecard. What’s a commuter pass, or Teiki? If you have a route you often take on the trains- for example, from your home to the office- it is cheaper to purchase a monthly Teiki. You can do this at any train station ticket booth or on your Suica/Pasmo app. Note: Suica Teiki’s are for use on the JR lines, and Pasmo Teiki’s are for the subway systems.

May your Tokyo cashless shopping be smooth!

Make shopping, train riding, and eating out, so much easier by having all your paying options set up on your phone! Both PayPay and Merpay give back rewards, so when you can, use those options instead of cash and take some weight off of your shoulders. We know how heavy those coins can get!

Welcome to the world of light wallets and quick and easy purchasing. 🙂